Origins of banking in Essex

The origin of banking in Essex is very

difficult to trace. In London banking began on something like modern

lines early in the eighteenth century. In Essex as in other country

districts the system began to grow up somewhat later with records

earlier than the beginning of the nineteenth centre extremely

meagre.

Baileys British Directory for

1784 gives a list of banks then existing in the Eastern Counties but

there is not a single Essex bank amongst them although the list

mentions eight banks in Norfolk, five in Suffolk, One in

Cambridgeshire, two in Kent and one in Surrey.

The lack of mention of any

Essex Banks was probably an oversight due to the fact that, in the

case of all early country banks, it is practically impossible to

assign any definite year of foundation. None of them was organised

or came into existence as a bank but all grew by degrees out of the

ordinary business operations of some leading country tradesman or

merchant ( such as a brewer , a tea dealer or a wool stapler) who

was obliged, in the ordinary course of his business, to maintain

correspondence with a banker or some sort of financial agent in

London. Such a man was often asked by his friends and smaller

tradesmen to oblige then by negotiating their bills and drafts along

with his own, through his London agent and thus by degrees he became

in fact a country banker, though still carrying out his original

business also. In the course of time the latter generally declined

and the banking business grew in importance til the man or business

became a banker solely. For this reason it is generally impossible

to fix upon any precise date as that of the change.

Twinnings and Mills

at Colchester

The earliest Essex bank was

that of Twinnings and Mills established at Colchester by Richard and

John Twinning who were well known tea dealers of the Strand, London

(founded 1710) and John Mills, tea dealer and leading tradesman who

lived and traded in High Street, Colchester. The bank was

established between 1769 and 1770. Later the Twinings retired from

this Bank although they continued to trade as both a Teas business

and Bank in the Strand , London.

After the Twinnings retired ,

John Bawtree of Colchester joined the Bank which became Mills,

Bawtree and co. Mills died at the age of 87 in 1822 and was

succeeded by his son, John Fletcher Mills. Later his son in law , G

H Errington became a partner and the firms was known as Mills,

Bawtree, Errington and co.

In 1883 Mr E H Dawnay and R

L Curzon became partners.

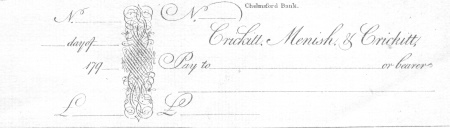

Crickitt and Co at

Chelmsford, Maldon and Colchester

Another early Essex bank was

that of Crickitt and co of Chelmsford, Maldon and Colchester.

The bank probably originated

in Colchester but ledgers for the firm show that it was carrying on

a regular banking business as early as 1774.

The ledgers were written with

extraordinary care and neatness.

In 1774 the partners were

Messrs R Crickitt and Bank House, Colchester , Mr George Round of

Lexden House, Colchester and Mr William Green of Stanway Hall,

Colchester.

In 1793 the firm became

Crickitt, Truelove, Kerridge and Crickitt but sound after the name

was changed again to Crickitt, Round and Co.

The Chelmsford Office was

known as Crickitt, Menish and Crickitt although it called itself the

Chelmsford Bank and opened an office from 9 am to 5pm on weekdays.

Copies of £1 and £10 notes as well a cheque books survive from the

Chelmsford Bank.

Anthony Cox at

Harwich and Manningtree

Before the end of the

eighteenth century Harwich had it's own banking form. Claims have

been made that the bank was founded in 1780 but probably it's

inception took place 10 years later.

In the early days the bank

belonged to a man called Anthony Cox and the probability is that the

business grew from Messrs Cobbold and Sons who were Brewers and

agents for the packet boats.

Anthony Cox was still listed

as Head in 1811 when for which year banking ledgers are available.

After 1812

amalgamation with other banks took place and the firm became

Bridges, Cox and Godfrey with branches in Manningtree, Harwich and

Hadleigh, Suffolk. In 1815 , owing possibly to the death of Mr

Bridges) a new partnership was arranged between Mr Cox and Mr Nunn

who represented the Manningtree Branch. Mr Godfrey and the Hadleigh

Branch left the firm possibly to join the firm of Mills, Bawtree who

became involved in banking at Hadleigh around this time.

In 1823 the bank became Cox

and Knocker once again reverting to banking at Harwich with the bank

at Manningtree going alone again.

In 1840 the bank became Cox ,

Cobbold and Co while trading as The Harwich Bank.

Sparrow and Co ,

Braintree and Chelmsford

The earliest years of the

nineteenth century saw the formation of Sparrow and Co which was

established at Braintree in 1803 by James Goodeve Sparrow of

Halstead who had married a Miss Crowe who was the daughter of a

banker at Bury.

The firm was at first Crowe,

Sparrow and Brown but the name of Crowe was soon dropped.

Almost at once the bank

extended it's operation to Chelmsford where it began business in

1806. At this time the partners were J G Sparrow ,George Brown,

Charles Hanbury ( of Halstead) and Joseph Savill. Thomas Simpson

joined soon afterwards.

Two old bank notes for £10

each issued by the firm trading as Essex and Suffolk Bank dates

1814 and 1823 still exist.

By 1830 Sparrow and Co were

trading as the Essex Bank with the word Suffolk dropped from its

title.

In 1838 Mr W M Tuffnell

joined the firm and was connected with it until his death in 1905.

The partnership in 1840 was

Sparrow,Walford,Nottage,Greenwood and Tuffnell

During the next forty years

there were many slight changes - Sparrow,Walford,Nottage and Day ;

Sparrow,Walford,Greenwood,Tufnell and Walford; Sparrow, Walford,

Round, Green, Tufnell and Round; Sparrow,Tufnell ,Round and Co.

In 1852 the partners were

Basil Sparrow, George Round ( Colchester) J W Eggerton-Green (

Colchester) W M Tufnell ( Chelmsford) and Edmund Round (

Springfield).

About this time Mr Woodhouse

and the late Mr John Oxley Parker joined the firm.

The later remained a partner

until his death when his son Christopher W Parker succeeded him.

In 1881 the title of the bank

became Sparrow, Tufnell and Co.

Billericay and

Rochford

At Billericay a firm called

Crisp and Butler was at work by 1808.

At a similar time The

Rochford Hundred and Billericay Bank was being run by John Whittle

Harvey of Hadleigh Hall, Leigh and Matthew Bernard Harvey.

Also involved in this

business were Messrs J and W New and then Messrs William and George

Jackson.

The firm ran into difficulty

in May 1814 when John Harvey became bankrupt and much litigation

followed.

Epping

Fincham and Co traded in

Epping describing themselves as bankers, dealers and chapmen

although they ran into financial difficulties and became bankrupt on

8 April

1816. The partners at this time were Benjamin Senior, Benjamin Junior and William Fincham.

The business was probably

taken over by the firm of Joyner and Co.

The Great Bank Panic

of 1825 and 1826

The most important Essex firm

in 1825 was Sparrow, Brown, Hanbury, Savil and Simpson of Chelmsford

which drew upon Barclay and Co.. This firm had branches in

Chelmsford, Billericay, Braintree, Coggeshall, Halstead and Witham .

Next in importance came

Crickitt, Ruffel and Co at Chelmsford and Maldon where the partners

were Sarah Crickitt, Robert Alexander Crickitt and Samuel Hunt

Ruffell, whilst they were called Crickit, Round and Co at

Colchester.

There was a firm at

Colchester called Mills, Bawtree and

Co and a connected firm called Nunn, Mills and Co at Manningtree.

At Romford and Epping were

banks belonging to Joyner, Surridge and Joyner who traded as Romford

Agricultural Bank.

Smaller firms were Searle,Son

& Co at Saffron Walden, Cox & Knocker at Quay Street, Harwich,

Mortlock & Co ( from Cambridge) at Saffron Walden and Alexander and

Co ( from Ipswich) at Manningtree.

In April 1825 a chain of

events began that was to change the face of Essex banking.

Following the end of the

Napoleonic wars Britain had entered a boom economy which coincided

with the opening of investments in South America.

Such was the popularity of

these investments coupled with a lack of knowledge that many

investors were encouraged to invest in the imaginary country of

Poyais. When the fraud was uncovered the scale of losses was so

great that the stock market crashed.

Mark bank account holders

were so alarmed that they queued to take their savings out of the

banks which resulted in some banks becoming insolvent. Three of the

Essex firms collapsed within a week and several others came close to

closure.

The crisis was eventually

solved by a large loan from the old enemies at the Banque de France.

The first Essex Bank to

collapse was Cricket and Co of Chelmsford who stopped payment on 24

December 1825.

Sparrow and Co took over the

Chelmsford branch but the Colchester branch of

Crickit, Round and Co managed to survive the crisis although this

seems to be mainly due to the efforts of a loyal customer called Rev

William Marsh if the below extract from a Round family diary is

correct.

On

one occasion during a commercial crisis in the country, a panic

occurred on a market day at Colchester, which seemed likely to prove

ruinous for a highly respectable banking house in the town. The

framers and many other depositors, who had assembled for the market,

rushed to draw out their money and the run on the bank was great.

Doctor Marsh having in his house a considerable sum of money in cash

, at once put it into a bag, took it across to the bank and paid it

in, in spite of the bystanders protesting that the bank was

breaking. taking heart, one by one, they went away. Mr Marsh

remained till the closing hour; confidence was restored; and the

bank was saved.

Dr Jonas Asplin also recorded

concern in his diary for Jan 1 1826 as recorded in Essex people

1750-1900 by A F J Brown.

In

the Dengie Hundred I am told it's is dreadful for there Crickett's

notes chiefly circulated,

The Cricket members of the

bank retired and it was reorganised to become Round, Green, Green

and Pattison.

On the 27th December 1825

came the suspension of Searle and Co of Saffron Walden.

Their place was taken by a

new firm called Gibson, Catlin and Co who were owned by Atkinson

Francis Gibson, Wyatt George Gibson, Jabez Gibson and Thomas Catlin.

These men were respected members of the community, three of which

were Quakers with the Gibson's running a brewery. They were

approached by several citizens asking them to start a bank to

replace the recently failed Searle and Co.

The new bank fared so well

that the Gibson's were able to sell the brewery a few years later.

The third firm to fail that

week was Joyner, Surridge and Joyner of Romford and Epping who

stopped payments on 2 January 1826.

Their business was taken over

by Thomas Johnson and Co which later became Johnson, Johnson and

Mann.

Two months later on 27

February 1826 when the banks thought that the worst of the panic was

over the largest bank of all, Sparrow and Co were obliged to suspend

payments.

A creditors meeting held on

7th March 1826 found that the banks assets were £312,019 whilst

their liabilities were £294,343 providing a surplus of nearly

£18,000 which when added to the wealth of Mr Sparrow which was

reported to be £12,000 per year and Mr Walford reported at £45,000

was more than enough for the bank to continue trading.

Although not directly connected with the Bank Crisis, a fourth firm

failed on 7 February 1827, when William Jackson of Rochford became

bankrupt. Rochford was left without a banker until Mr J Giles

started a new bank in 1830.

Hill and Sons at

Romford

In 1825 Charles Hill formerly

a banking clerk in the banking house at Sharp and Sons began a

banking business at 17 West Smithfield, London with an office at

Romford.

The Romford office only

opened on Wednesdays when the great weekly cattle market was held.

Charles Hills and his

sons George and John, and then John's son also called John carried

on this business for many years acting as an agent to cattle

salesmen.

Charles Hill died in 1846 ,

John Hill senior died in 1867 and George Hill Died in 1879.

On the death of John the

partners were George Hill, John Hill jnr, Henry Meakins Hill and

Herbert Hill.

Since then three of the sons

of John Hill (Charles Hill, John Norman Hill and Richard Alexander

Hill) as well as two nephews (Montague Henry Hill and Leonard George

Hill) have been taken into the partnership.

By 1882 Hills opened their

bank daily to cater for the many local farmers who sold stock or

received money for stock sales via Hills.

Absorption of the

Private Banks

In 1840 signs were detectable

that the smaller private banks were being absorbed by the larger

banks often from nearby London.

The first move was by the

London and County Bank which opened branches in Braintree ,

Chelmsford , Maldon, Halstead, Romford , Coggeshall, Chipping Ongar,

Saffron Walden and Colchester between 1839 and 1852.

In 1853 Sparrow and Co

absorbed Giles Rochford Bank and soon after Nunn, Mills and Co was

taken over by the London and Country Bank.

At this time the partners of

Nunn, Mills and Co were Thomas W Nunn of Lawford House and Mr

Carrington Nunn of Little Bromley Hall.

In 1863 Gibson and Co tried

to resist the tide taking on new partners William Murray Tuke,

Edmund Birch Gibson and George Stacey Gibson to become Gibson,Tuke

and Gibson.

The London and Provincial

Bank were the next to move in with thirteen branches in Essex

followed by the London and South Western bank with 7 branches , The

London Joint Stock Bank with 6 branches , Parr's Bank with four

branches and the Capital and Counties Bank with five branches.

In July 1891 Round,

Green,Hoare and Co of Colchester amalgamated with many other small

banks to become Gurney and Co based at Norwich.

On 8 December 1891

Mills,Bawtree,Dawnay,Curzon and Co of Colchester which had branches

at Clacton, Witham, Walton, Kelvedon and Hadleigh in Suffolk failed

and was taken over by Gurney who were able to offer 10 shillings for

the pound.

On 1 January 1893 the old

firm of Cox, Cobbold and Co of Harwich trading as the Harwich Bank

amalgamated with Bacon, Cobbold, Tollemache and co of Ipswich to be

called Bacon, Cobbold and Co.

In 1896 Barclay and Co of

Lombard Street absorbed three Essex Banks - Sparrow, Tufnell and Co

, Gurneys and Co and Gibson , Tuke and Gibson of Saffron Walden

making it the largest banker in Essex with thirty six branches.

The disappearance of our

private banks became practically complete on 2 January 1905 when the

Capital and Counties Bank absorbed the bank of Bacon, Cobbold and Co

at Harwich and Dovercourt and that of Foster and Co at Saffron

Walden.

The

primary source for the above article was The History of Banks and Banking in Essex

by the Essex Historian Miller Christie which he published in 1906